Situation: Cyclone Natural Disaster Response

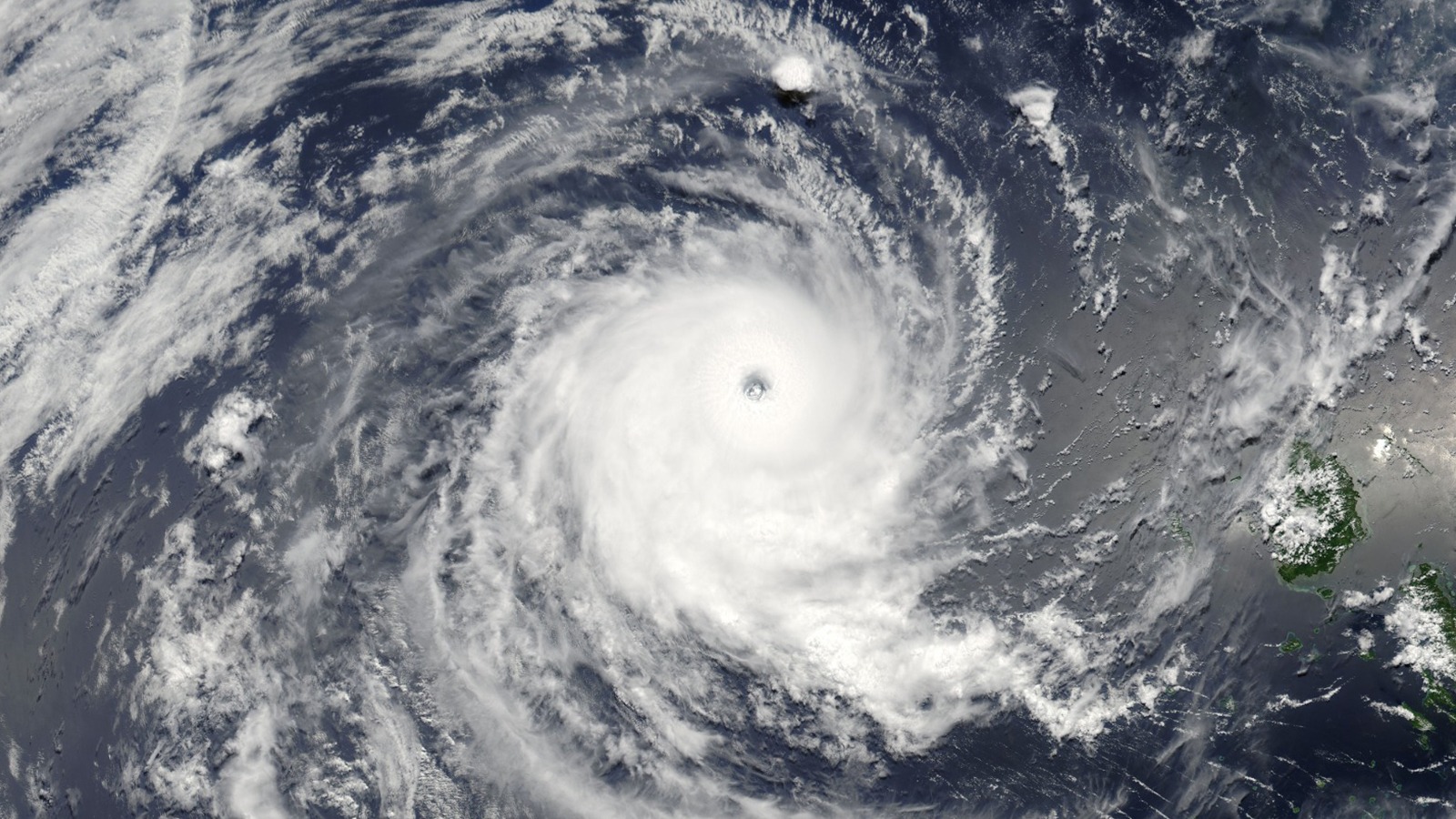

In November 2024, Cyclone Fengal made landfall between Karaikal and Mahabalipuram, severely affecting Puducherry, Tamil Nadu, and parts of Andhra Pradesh in India. With wind speeds of 94 km/h, it caused record rainfall, urban flooding, and major disruptions to infrastructure and commerce. For a leading insurance company, the cyclone posed a multi-dimensional challenge, necessitating immediate activation of disaster response protocols, early estimation of claim exposure, risk-based prioritisation of policyholders, and coordinated communication with regulators and insurers.

Challenges?

Operational Challenges

- Inaccessibility of affected areas delaying physical claim verification and surveys

- Damage to servicing branches, field offices, and operational infrastructure

- Disruption to policyholder communication due to internet and mobile network failure

- Strain on call centers and claims servicing units due to spike in volume

- Severe waterlogging and breakdown of electricity, internet, and telecom infrastructure

- Risk to employee safety, office premises, warehouses, and transport fleets

Financial Implications

- Massive surge in claims from motor, home, and health policyholders in flood-affected areas

- Risk of underwriting losses and short-term liquidity pressure due to high-volume payouts

- Increased dependency on reinsurance with tight reserve margins

Regulatory & Compliance Pressures

- IRDAI-mandated timelines for fast-track claim settlement and nodal officer deployment

- Requirement to simplify documentation norms under disaster-relief conditions

- Expectations of structured, event-specific loss reporting and disclosure compliance

Reputational Risks

- Risk of eroding customer trust due to perceived inaction or delay

- Potential long-term impact on brand perception and policy renewal rates

How did Datasurfr help?

| Proactive Risk Management | The upcoming section provided advance alerts on landfall zones and rainfall severity based on IMD and satellite data days before its arrival. Risk Analytics for Region provided historical intelligence for scenario planning and underwriting. Risk Advisories and Special Reports provided in-depth analysis along with GIS-based flood exposure reports to help insurers and corporates understand geographic risk clusters. | The insurance company enabled business continuity plans for zonal offices and claim servicing hubs, relocated critical functions, pre-positioned emergency equipment and facilitated reserve planning by visualising early potential impact zones. |

| Real-Time Response | Live Monitoring Tools: Interactive maps and real-time alerts enabled the security and operations teams to track flood impacted areas, wind speeds and access routes. 24×7 intelligence analyst support provided round-the-clock assistance and in-depth intelligence information on request. | Activated the emergency protocols, conducted alternative routes to ensure employee protection, and coordinated with external agencies. |

Impact

- Clients implemented response actions 36 hours before landfall, reducing exposure to physical damage

- Ensured continuity of critical services and zero casualties reported among client personnel

- Enabled early damage documentation, accelerating claim settlements and reducing disputes

- Supported reputational resilience by maintaining stakeholder trust through proactive communication and timely action.