In the age of risk complex landscape, enterprises adapting to changing times and practicing risk management practices are better equipped to deal with the rising web of risks. Risk Intelligent firms not only face uncertain times with confidence but also are able to utilise them to create new opportunities. Risk aggregation and the intertwined nature of risks lead to an uncertain assessment of likelihood and impact.

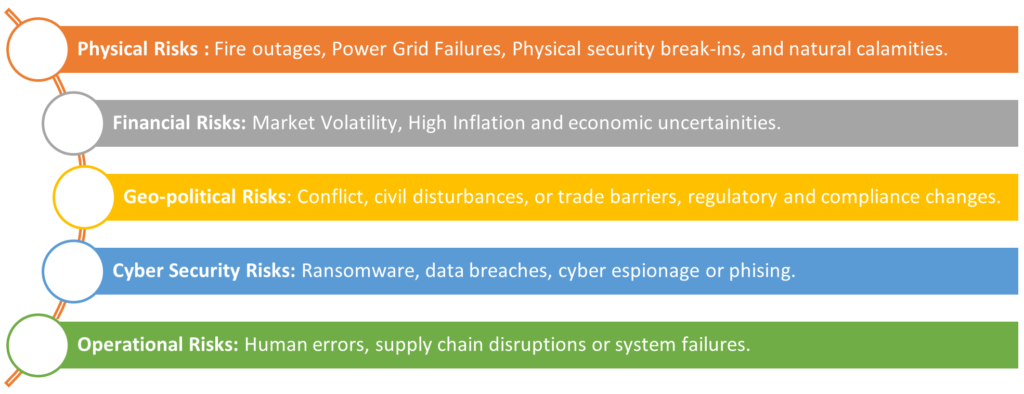

Risks could be of varied nature –

Risk Management Strategies

Risk Identification

- Using Risk Intelligence, predicting potential risks and threats that may impact your organisation.

- Collecting diverse data from various sources using OSINT from local media, public reports, and social media.

- Conducting automated vulnerability assessment with the help of technological tools to monitor and identify gaps and lacunae in the system.

Risk Assessment

- Conducting Threat Vulnerability Assessment to understand the organization’s risk appetite and to reduce its vulnerabilities.

- Creating a Risk Matrix to prioritise risks with respect to their likelihood and impact on the business. This would ensure the optimum utilisation of limited resources.

- Creating Heat Maps to understand the complex web of risks that are likely due to the domino effect.

Risk Mitigation

- Risk Acceptance: Accepting the risk and its consequences without taking any action for it. This is suitable when the likelihood and impact of risk are low and the cost of mitigation outweighs the potential benefit.

- Risk Avoidance: Avoiding the risk when the consequences of risks are high and the mitigation cost outweighs the potential benefit.

- Risk Transfer: Transferring the risk to another third party when the impact and likelihood of the risk is high with significant mitigation cost. For instance, purchasing an insurance policy to safeguard assets.

- Risk Diversification: Spreading out the risk over various projects, investments, or business operations to reduce the high impact of risk in one area.

- Risk Reduction: Reducing the likelihood of the risk and possible impact by reducing vulnerabilities within the limited budget.

- Scenario Planning and Stress Testing: Testing organisational resilience in various potentially risky scenarios and evaluating the business resilience.

Risk Monitoring and Review

- Continuous monitoring of evolving threats with the help of technological tools including AI and predicting potential risks.

- Reviewing the efficiency of current risk management practices with respect to evolving threats.

- Creating a specialised team such Global Security Command Centre to keep track of new threats and timely intervention for risk mitigation.

Risk Communication

- Conducting risk awareness seminars to equip employees and stakeholders with new-age risk intelligent practices.

- Fostering better communication among the various internal and external stakeholders.

ADAPTING TO EVOLVING RISKS

- Financial Risks and Economic uncertainty:

- To mitigate the economic uncertainties and financial risks, several techniques including cost optimisation, product and revenue diversification, as well as creating financial buffers can help increase financial resilience.

- Geo-Political Risks:

- Various measures including supply chain and operational diversification, Political risk insurance, and OSINT tools can help mitigate the risks.

- Physical Security Risks:

- Security measures including purchasing insurance safeguarding assets and operations, leveraging technological tools such as AI and IoT to monitor the security infrastructure, and creating critical event management plans can be used to mitigate risks.

- Cyber Security Risks:

- Risk Mitigating measures including purchasing cyber insurance, creating an incident response team, and implementing Zero Trust Security Model to ensure cyber resilience.

Thus, a risk-intelligent firm is better equipped to deal with complex risks and their potential impact while securing its interest as well as expanding its opportunities.

Partner with Mitkat to be a Risk Intelligent Firm

Mitkat offers a variety of services including Risk Consulting and Security Design, Protective Services, and cyber security services which help organisations to not only survive but also thrive in uncertain times. Our tailored risk analysis and risk-mitigating solutions help organisations navigate evolving security landscape and complex risks. Our AI-powered operational risk monitoring tool, datasurfr combined with expert insight enables companies to stay abreast of evolving operational risks and emerging developments.